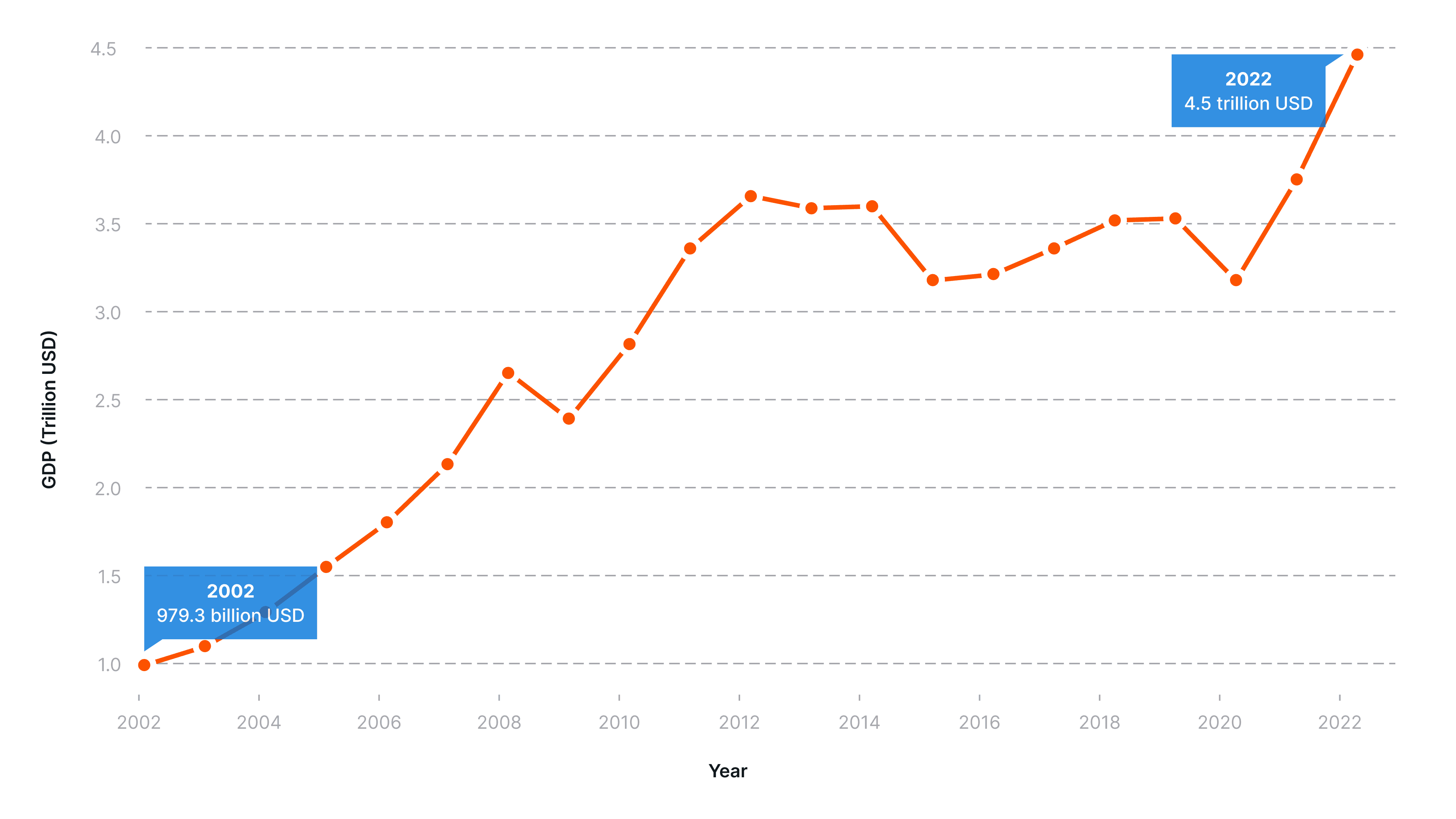

Boasting a youthful, tech-savvy population, growing disposable income, and ambitious government initiatives aimed at economic diversification, the MENA region offers many expansion opportunities for global businesses. However, to succeed in the Middle East, companies must be mindful of the unique socio-economic, cultural and regulatory landscapes of the region.

In the last 18 months, numerous companies decided to choose Dubai as their international hub and operate out of Dubai to the world. Some of those companies decided to leave their home markets for the first time. We also see many entrepreneurs and founders decided to move to Dubai or re-domiciled here.

A Culture of Luxury:

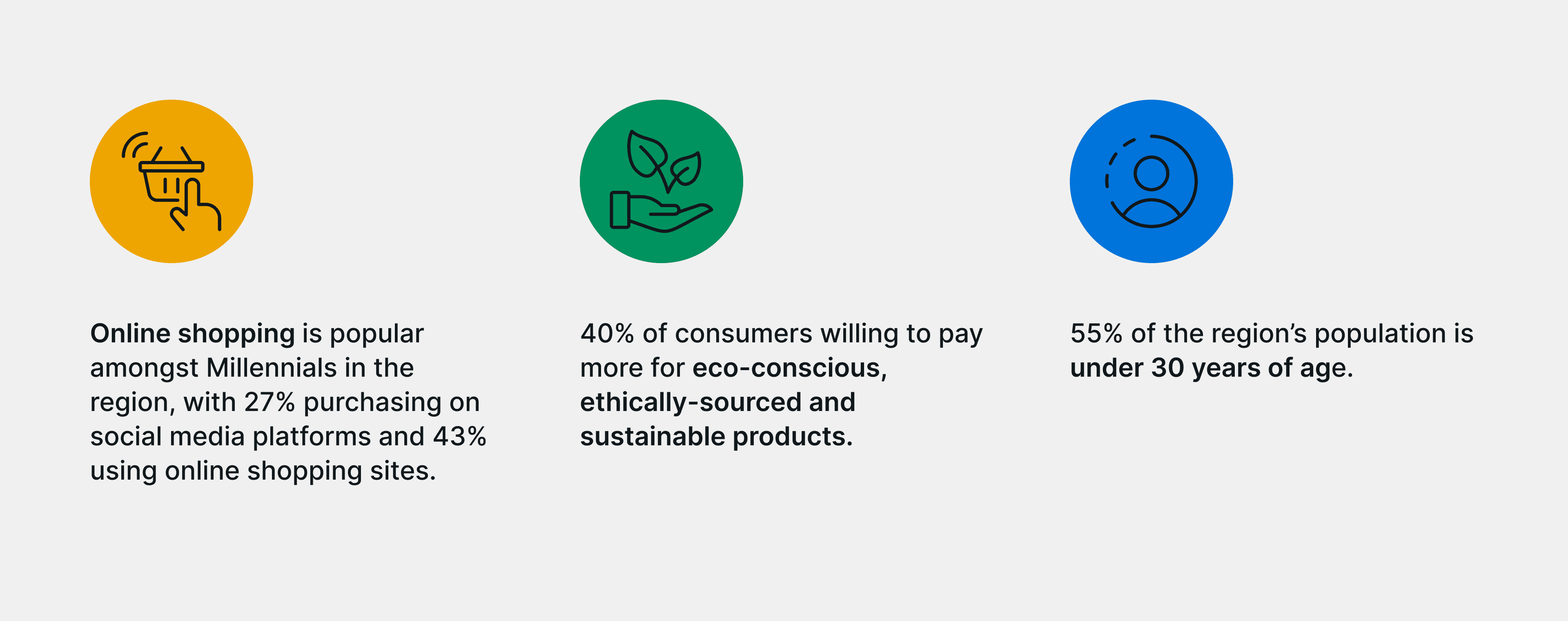

Consumers in the Middle East have a strong affinity for global luxury brands, particularly in fashion, beauty, car, and hospitality. Vogue cites the GCC as the ‘Mecca of Malls’, highlighting the pull for luxury brands into the region¹¹. Cities like Dubai and Riyadh are emerging as hubs for luxury retail, with global brands setting up local flagship stores, such as Prada, YSL and Chanel¹². The regional definition of luxury is extending, to include sustainability, with 40% of consumers willing to pay more for eco-conscious, ethically-sourced and sustainable products¹³.

Challenges of Expanding into the Middle East

Regulatory Complexity:

The Middle East consists of several countries, each with its own regulatory framework. Navigating this unique regulatory landscape can be challenging, particularly in terms of licensing. In countries like Saudi Arabia, there are clear guidelines regarding local hiring practices, whilst in the UAE there are different regulatory rules for free zones and mainland businesses. It's essential for brands to understand the local laws and partner with local experts to ensure compliance.

Heterogeneous Consumer markets:

A sweeping one-size-fits-all model will not work for a Middle Eastern expansion plan. Each consumer market is unique despite certain shared characteristics across the region. Consumer expectations, lifestyles and preferred shopping or payment methods can differ. For example, we have seen an uptick in mobile payments for Egypt and Jordan which has not been a significant feature for regional payment markets elsewhere.

Three Strategies for expanding into the Middle East

Localise the product to appeal to the cultural values of the region’s consumer segments.

Pursue an omnichannel approach where possible, to merge digital and physical customer experiences.

Invest in strategic partnerships* to mitigate operational overhead and regulatory risk.

* Fuse is built for global businesses expanding into the Middle East. We’re a financial infrastructure company enabling money movement in, around and out of the region without the need for local entities, compliance, and currency management - powered by a first of its kind Virtual IBAN solution in the region.

We believe it is the most exciting hub for commercial opportunities yet, despite the push for innovation, there is still limited payment and financial infrastructure. That’s why we built Fuse - a solution for the region. We’ve helped many big brands, from ecommerce marketplaces, social media platforms and EMIs, to access the region. If you’re looking to the Middle East as part of your expansion roadmap, reach out to us to explore our payment solutions.

P.S. For more insights about the region and its various markets, download our How Money Moves in MENA report.

—

Sources

https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=ZQ

https://u.ae/en/about-the-uae/digital-uae/digital-cities/smart-sustainable-cities

https://www.oecd-ilibrary.org/sites/bcc2dd08-en/1/3/1/index.html

https://www.vision2030.gov.sa/media/rc0b5oy1/saudi_vision203.pdf

https://www.khaleejtimes.com/business/multiple-firms-move-global-head-offices-to-dubai-in-18-months

https://www.khaleejtimes.com/business/multiple-firms-move-global-head-offices-to-dubai-in-18-months

https://www.voguebusiness.com/story/consumers/the-future-of-luxury-in-the-gulf

https://news.fazwaz.ae/guides/top-5-must-visit-luxury-brand-flagship-store-in-dubai/